The Bitcoin price has once again surpassed the $47,000 mark. One reason for this seems to be the continued interest in Bitcoin spot ETFs.

The net inflows continue

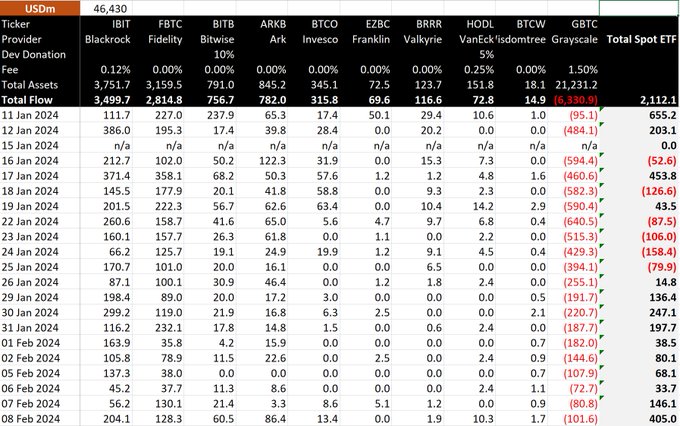

Despite a slight decrease in ETF inflows in the first week of February, data from Farside Investors and BitMEX shows net inflows of $403 million and 8,935 Bitcoin yesterday. This marks the third-largest net inflow after January 11th ($655 million, 14,193 BTC) and January 17th ($453 million, 10,644 BTC).

The BlackRock ETF (IBIT) saw the largest inflow, approximately $204 million or 4,500 Bitcoin, bringing total inflows to $3.5 billion. Fidelity’s ETF (FBTC) also saw inflows of around $128 million (2,830 BTC), bringing total inflows to over $2.8 billion. Behind BlackRock and Fidelity are Ark (ARKB) and Bitwise (BITB) ETFs, each with total inflows of over $750 million.

Yesterday, over $100 million flowed out of Grayscale’s ETF (GBTC), significantly less than in the first weeks after approval. Total outflows from GBTC now exceed $6.3 billion. However, the total value of traded Bitcoin ETFs is now significantly positive at $2.1 billion.

Correlation between ETFs and Bitcoin Price

The renewed upward trend in ETF net inflows also boosted the Bitcoin price, which is now well above $47,000. This demonstrates continued interest in the investment instrument and strong overall inflows. BlackRock and Fidelity have already secured the top two spots in the list of the 25 largest ETFs by assets after less than a month, each with over $3 billion. Bitwise and Ark are also represented in this list.

Furthermore, the upward trend indicates a strong correlation between ETF net inflows and the Bitcoin price. The six trading days with net outflows – January 16th, 18th, and 22nd to 25th – coincide with the downtrend and the current interim low of the Bitcoin price. However, the selling pressure, caused for example by the liquidation of GBTC shares by FTX and the BTC sell-off by Bitcoin miners, should not be neglected. This selling pressure has now subsided, and we can observe a parallel increase in ETF inflows and Bitcoin price. It remains to be seen whether this correlation will continue.